Limit Orders

Your Entry, Your Rules.

Limit orders let you buy or sell a token at your chosen price. Unlike market orders, which execute immediately, limit orders only execute if the market reaches your target.

Limit orders are live on Nexa, and you can use them to automate entries and exits with precision.

How to Set Limit Orders on Nexa?

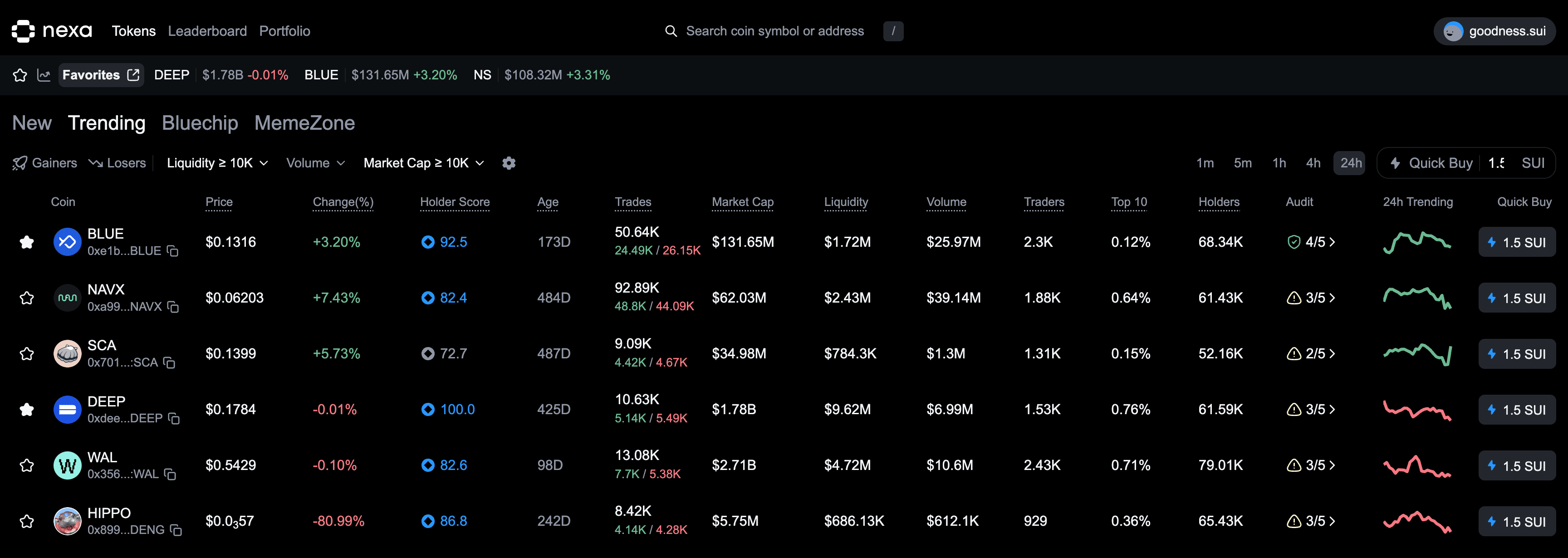

Select & Open the Coin

After onboarding, You’ll need to open the page of the specific coin you want to place a limit order on.

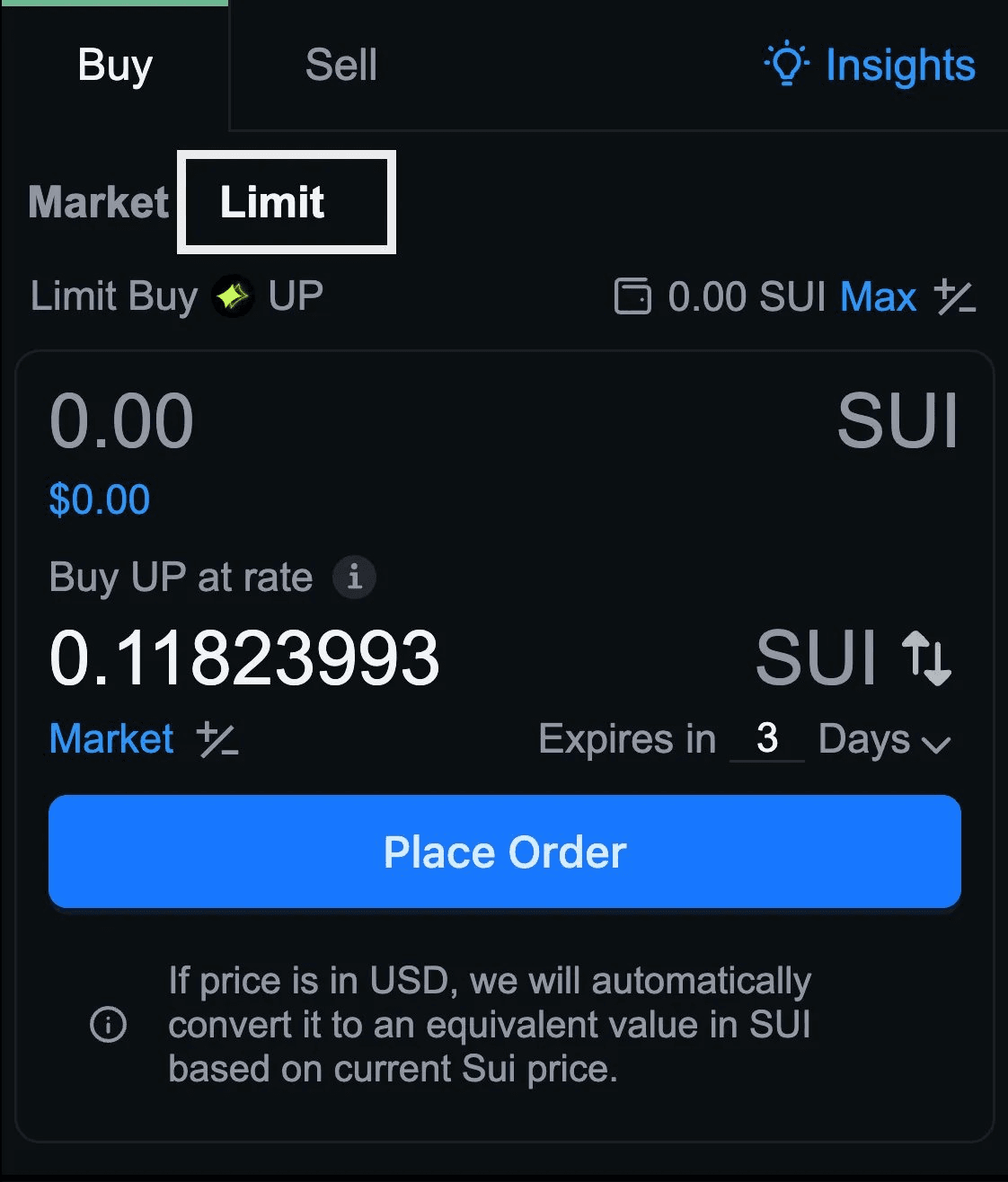

Click the Limit Tab

You need to click the limit tab to specify that you want a limit order. By default, it should be in market.

You’ll also need to click the buy/sell tab depending on if you’re trying to buy or sell

Set Entry Price, Amount and Expiry

Enter the entry price/rate and the number of Sui you’re willing to spend on that order.

You’ll also need to specify an expiry date for the limit order which after that time, the limit order wouldn’t

be active.

If price is in USD, we will automatically convert it to an equivalent value in SUI based on current Sui

price.Placing limit orders may not be fulfilled.

If price is in USD, we will automatically convert it to an equivalent value in SUI based on current Sui

price.Placing limit orders may not be fulfilled.

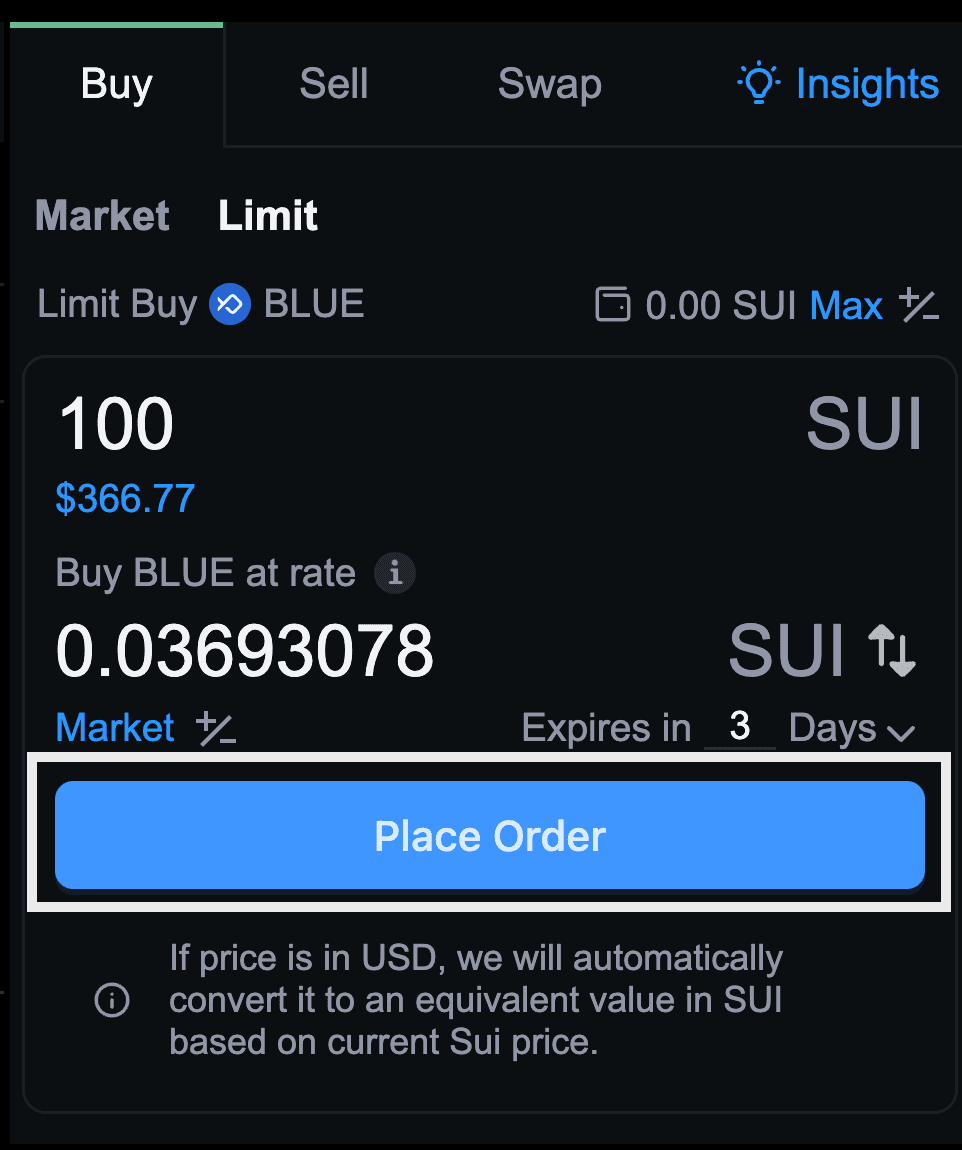

Place Your Order

Click on Place Order to place your order, sign the transaction prompt in your wallet and you’ve successfully

placed the order.

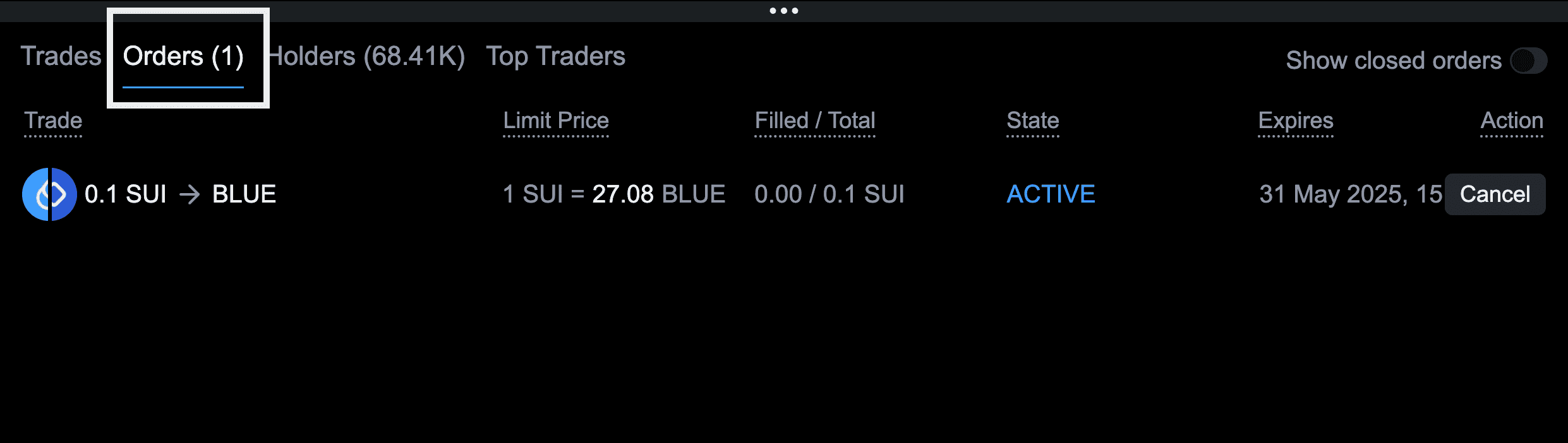

Manage Your Order

You can manage your order from the Orders tab on the lower centre of the UI.

Order Execution Notice

- Limit orders may or may not be filled depending on market conditions.

- Order execution depends on price action reaching your specified price.

- Other factors like liquidity and slippage can affect execution.

- Orders will automatically expire at the specified expiry time.

- Consider market volatility when setting limit prices.

You can use limit orders to execute dollar cost averaging (DCA) at varying prices. Generally, limit orders are great for long-term investments, as they allow you to purchase tokens at a predetermined price range.