Impermanent Loss Tracker

Track and monitor impermanent loss in your liquidity positions

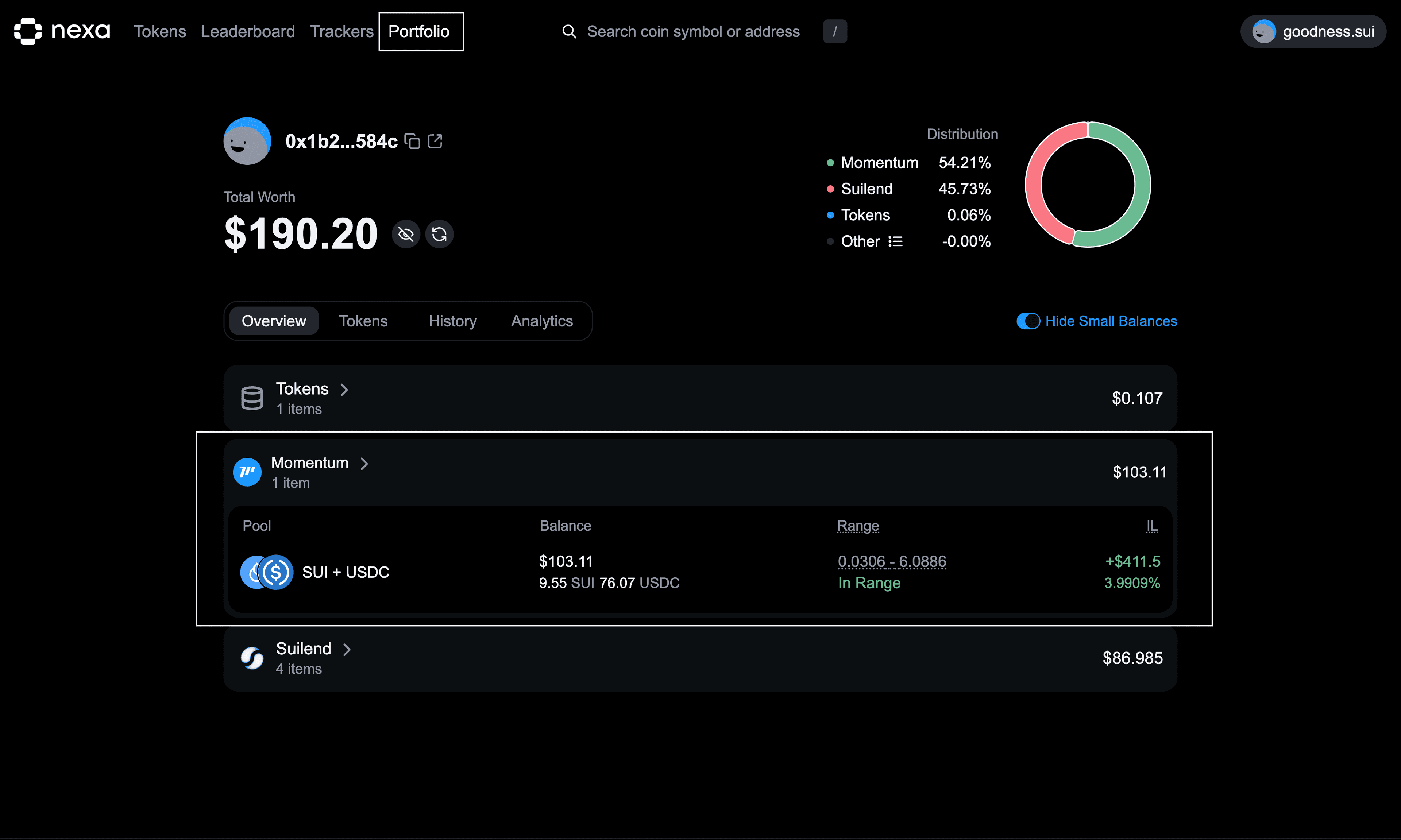

Nexa's Impermanent Loss Tracker helps you monitor and understand the performance of your liquidity positions across different DEXs on Sui. Track your IL in real-time and make informed decisions about your liquidity provision strategies.

Impermanent loss occurs when the price ratio of tokens in a liquidity pool changes compared to when you deposited them. Our tracker provides detailed insights to help you understand and manage this risk.

Impermanent loss is "impermanent" because it only becomes permanent when you withdraw your liquidity. As long as your tokens remain in the pool, there's potential for the loss to decrease or even turn into a gain.

Tracking LPs & IL

Visit the Portfolio Overview

To start tracking impermanent loss, you first need to provide liquidity to a pool. Nexa makes this process simple:

- Select a Pool: Choose from available liquidity pools on supported DEXs

- Add Token Amounts: Input the amounts of both tokens you want to provide

- Confirm Transaction: Review the details and confirm your liquidity provision

The tracker will automatically start monitoring your position once the transaction is confirmed.

Viewing Your Position

Once you've provided liquidity, you can view detailed information about your positions:

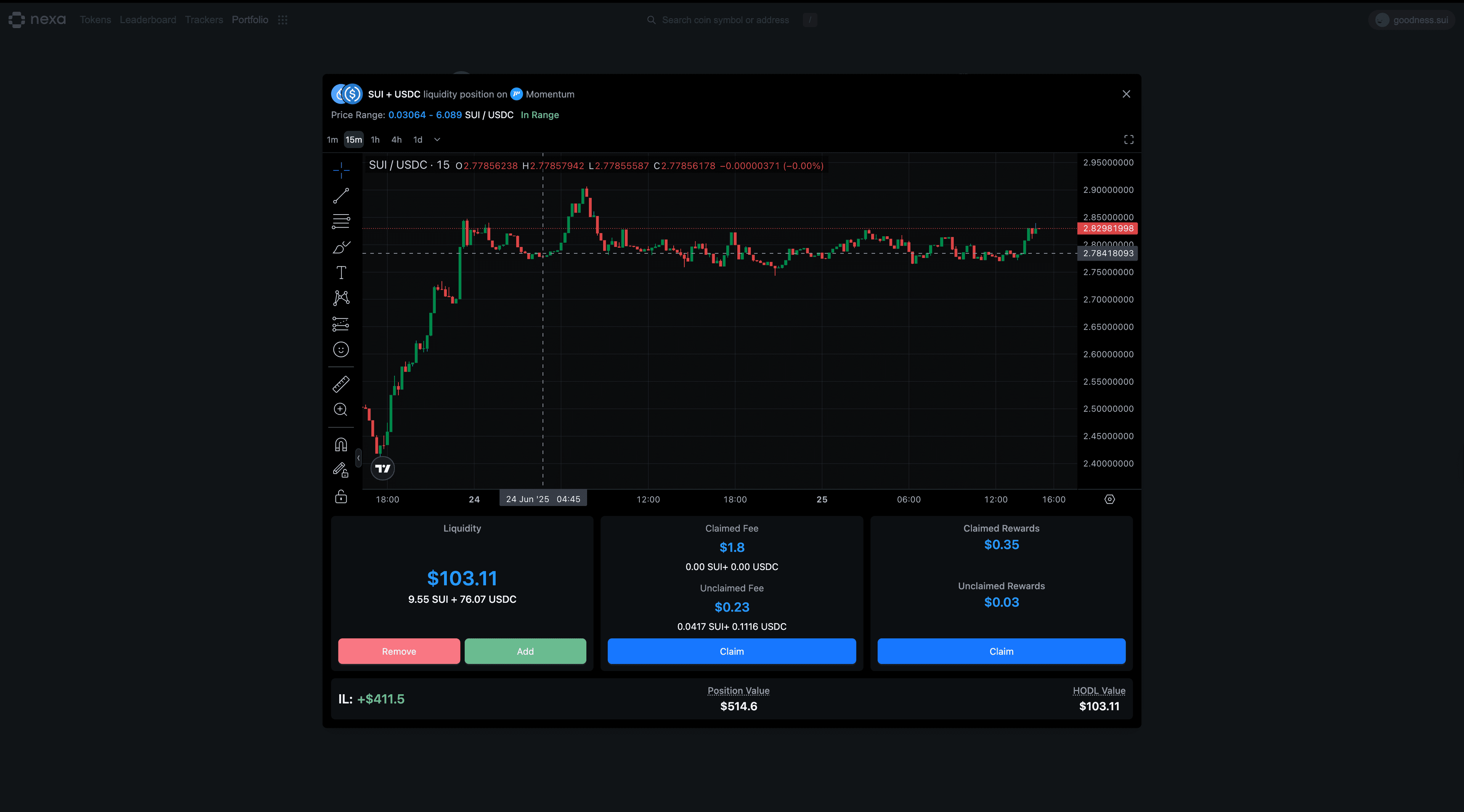

Understanding the Metrics

- Price Range – The price band you set; you only earn fees while the market price stays inside it.

- In Range / Out of Range – Shows whether the current price is inside that band (earning) or not (idle).

- Liquidity – Dollar value of the tokens you have deposited into the pool.

- Claimed Fee – Trading fees you’ve already withdrawn to your wallet.

- Unclaimed Fee – Fees your position has earned but you haven’t withdrawn yet (click Claim to collect).

- Claimed Rewards – Any incentive tokens you’ve already harvested (separate from trading fees).

- Unclaimed Rewards – Incentive tokens accrued but still sitting in the position.

- IL (Impermanent Loss/Gain) – The difference (positive or negative) between the value of your deposited tokens now versus just holding them 50-50 outside the pool.

- Position Value – Current market value of everything in the position, including earned fees/rewards still inside it.

- HODL Value – What the original tokens would be worth if you had simply held them, no pooling.

Adding and Removing Liquidity

You can add and remove liquidity right from Nexa. Click on the Add/Remove buttons to adjust your position.

You can add and remove liquidity right from Nexa. Click on the Add/Remove buttons to adjust your position.

Claiming Fee Rewards

You'll earn trading fees from your liquidity positions and you can claim them from Nexa when ready:

Pro Tips

- Use our IL calculator before adding liquidity

- Consider impermanent loss protection pools when available

- Factor in opportunity cost of holding vs providing liquidity

- Monitor correlation between token pairs in your pools

The Impermanent Loss Tracker is an essential tool for any serious liquidity provider on Sui. Start tracking your positions today to make more informed DeFi decisions.